As you are probably aware, more and more people are starting to earn a living by working for themselves. We live in times when freelance jobs can give us a lot of freedom, and quite a decent income. But depending on what you do for a living, there will come a time when you should be considering incorporating your business. This can happen for various reasons, for example, you already have a registered business, and you’re looking to take advantage of expanding it. But just like everything in life, incorporation too, has its pros and cons.

To make the most out of this move, you need to arm yourself with valid information. For this reason, we have decided to list all pros and cons of corporation in Canada. Read through this article and gain clarity on important information.

Pro – The level of risk will significantly decrease

Business is all about taking a risk, but some of it can be either minimized or entirely skipped. Here’s an example, when you still haven’t incorporated your name on every single invoice you issue, as well as every single contract you sign. By incorporating, you’ll be avoiding this, as your company will start being its own person in the eyes of the law. Therefore, whatever goes wrong, your name is not held accountable. The company’s name is.

Let’s illustrate. If you have signed a lease contract and something unexpected happens, making you are not able to afford it anymore. Although it won’t be pleasant, the good thing is that you personally won’t be compelled to pay – the company will.

This doesn’t mean the whole responsibility will be gone, but a lot of contractual obligations will be off your back. Since it is in your best interest that the business keeps going you’ll most likely hire professional help, like an attorney to help you go through the court procedure, especially in cases when the creditor tries to go after you personally.

Con – Company name sometimes won’t be enough

Having a successful business means having a positive image in the environment you do business in. Although at some point incorporation may sound like a good idea, you’ll need to invest some effort in creating an image for the name. For example, if the name sounds familiar to banks, and they know it’s a business with good history, the chances of them approving your loans increases.

The responsibility, however, of paying the loan back in most cases will be on the owner’s back.

Pro – Legitimacy

Being unincorporated means something like being a one-person sales job, making buyers reluctant to trust the whole concept. Being incorporated, on the other hand, means what you do is legitimate. Buyers and people you do business with perceive you as serious. For example, some lenders or suppliers prefer to do business with registered entities, as they seem more stable.

Being incorporated also provides a chance for attracting outside investments. It opens a whole box of possibilities for outside funding, which is not the case with unincorporated businesses.

Pro – Corporation is way beyond individuals

When you run a business yourself, it is entirely tied to you as a person. Meaning that the moment you decide to quit doing it, sell it, or do something else, it seizes to exist. While corporations have continuity, as they carry on with what they are supposed to do even when crucial people change. When you decide to sell, it’s a lot easier.

Con – The process is expensive

There are a lot of expenses regarding maintaining everything according to the law, once you decide to go corporate. Going corporate itself costs money, not to mention the expenses of keeping records, and so on.

When going corporate in Canada, you can either do it with your own resources, or hire professional help which tends to cost a bit more, but takes a lot of burden off your back. For 1,500 CAD it’s worth it.

The price tends to vary depending on how complicated the structure of the future company is, for example having multiple partners aiming to set up a family trust, but still, is of great help. Especially when it comes to avoiding tax issues in the long run.

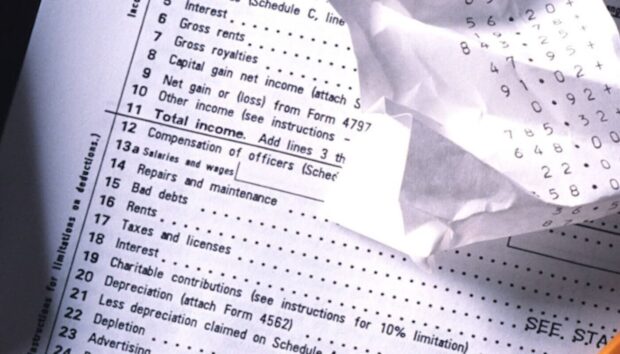

Con – archiving can be complicated

According to Canadian laws, every legal entity registered as such is obliged to keep a collection of records, that include everything from meeting minutes to information on the shareholders, directors, etc. This is especially important if you wish to attract investors, and expand your funding. Having everything super tidy and clear is a must in this case.

For a company to be in good standing, your province will require you to fill in a provincial register. This you need to remind yourself of, as no one will do it for you.

Pro – Tax flexibility

Being a legal entity of its own, a company has its own set of taxes that require regular payments. In some provinces, like BC, for example, these taxes are lower than personal ones. When you leave a certain amount of money to circulate within the corporation means you’ll have to pay fewer taxes.

In other cases, the money you take to pay for this yourself is considered personal income, and tax rates increase. But going corporate shouldn’t be done just to avoid all this. Remember, CRA can come knocking on your door as soon as they sense something fishy.

Con – Personal returns are easier to get done

Although what we mentioned above seems like a good reason to go corporate, not everything about these tax returns is simple. For example, filing for corporate ones is still slightly complicated. It can be done by yourself, but it’s highly advisable to seek an accountant’s help if you don’t feel 100% confident about it. Personal tax returns on the other hand are free and can be filed online.

As you can see, there are a lot of positives and negatives. It is on you to decide which road to take with your business.

Jewel Beat

Jewel Beat